Independent advice is objective advice.

As an independent, fee-only advisory firm, BLRS operates with a fiduciary responsibility to act in the best interest of each client. We do not answer to a brokerage firm or insurance company,

nor are we pressured to sell proprietary products.

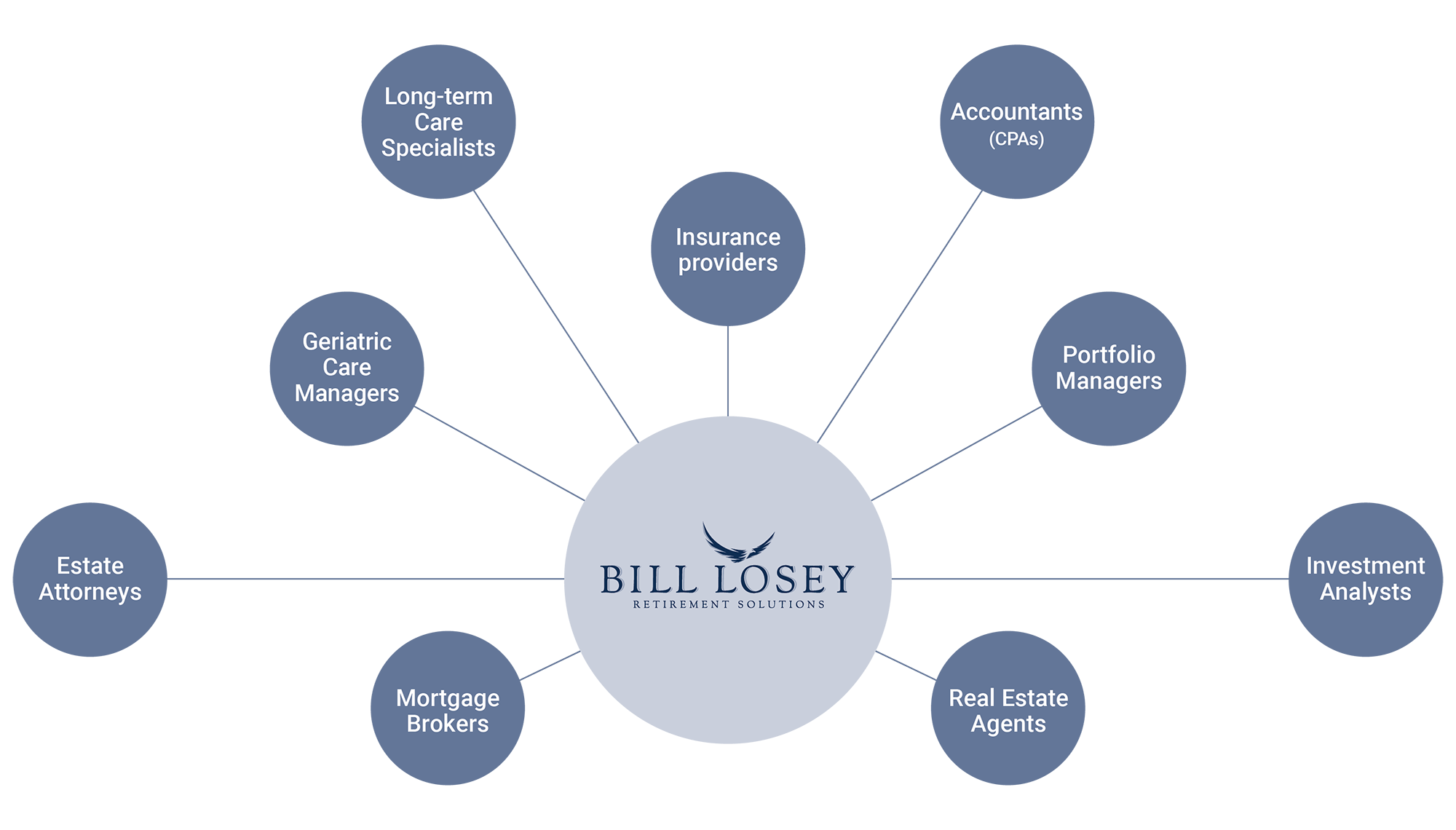

Instead we have formed strategic relationships based on merit and the capacity to enhance our client services. We have the freedom to pick and choose solutions that are right for each individual we work with.

In order to deliver a holistic retirement solution, we have selected SEI Investments (NASDAQ: SEIC) to provide our clients with investor protections, custodial services and investment technology solutions.