As featured on

Having earned national recognition and acclaim through popular media appearances and published content, he works with a small circle of private clients from coast to coast to deliver an all-encompassing retirement income, investing and portfolio management service.

It isn’t always 62 or 65, and it isn’t necessarily the same year you start collecting Social Security—in fact, it could be today. We take a broader look at your goals and your resources to determine what has to happen financially for you to make work optional. Learn more

Some say you need 70-80% of your pre-retirement income to live comfortably in retirement, but it all depends on what kind of lifestyle you want. Through what we call The Science of Successful Investing, we weigh all relevant factors and apply a clear methodology to build an investment portfolio around your goals. Learn more

Your investment risk profile changes as you approach retirement, but overall it’s about balancing the growth you need to meet your goals with the strategies that will help minimize the potential for loss. Learn more

The 4% rule of thumb is one place to start, but answering this question starts with an understanding of how savings, income, Social Security and health status can all contribute to the longevity of wealth. Especially for women, retirement can be a decades-long journey, so it’s essential to have a strategic plan in place to make your money last. Learn more

The Safe Money Benchmark Strategy™ is a unique process that helps preserve your core retirement savings, while harvesting investment growth in order to generate predictable income. Learn more

BLRS takes a comprehensive approach to assess your income sources and retirement accounts for tax-saving opportunities. With tax loss harvesting and other tactics, you can keep more of what you earn. Learn more

Sometimes a change of residence is the best way to make work optional, and other times it’s an unnecessary step that can be avoided with intelligent income and investing strategies. Learn more

Depending on a number of factors, claiming Social Security too early can leave tens of thousands of dollars on the table. Since each individual’s situation is different, we complete a thorough analysis to help you maximize your lifetime benefit. Learn more

Everyone needs a strategy to protect and control their assets in the event of a change in health status. BLRS consults with a long-term care strategist and can coordinate with your attorney to design a strategy that works for you. Learn more

Retirement planning is about building financial independence, not just wealth. This entails asset protection, predictable income, and a well-balanced portfolio. BLRS provides a simple, systematic approach to crafting your financial independence strategy. Learn more

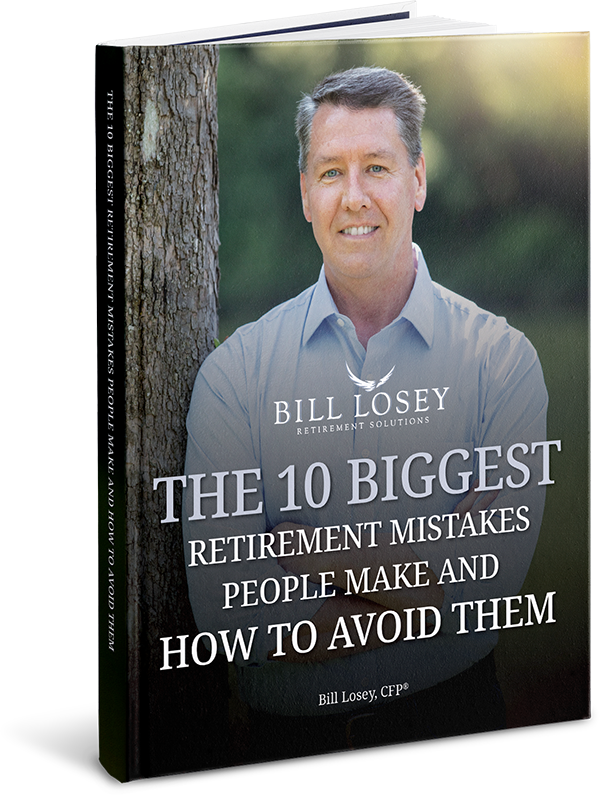

After 30+ years, the biggest retirement missteps seem to be as common as they are avoidable. So we wrote them down.

Download: The 10 Biggest Retirement Mistakes People Make and How to Avoid ThemComplete the fields below and your free Retirement Readiness Kit will be on its way to you within one business day.

Simply input your email address and the file will download directly to your computer. Check your Downloads folder or the bottom of your browser window to view.